Stablecoins like USDT and USDC represent a groundbreaking trend in the digital currency domain. Their primary role is to offer a stable value, a stark contrast to the usual volatility of other cryptocurrencies. Essentially, these are digital currencies pegged to stable assets like the U.S. dollar, ensuring a predictable and steady value in the dynamic crypto environment.

Table of contents

Introduction

Stablecoins have revolutionized digital asset transactions by enabling efficient peer-to-peer exchanges without third-party interference. This advancement reduces transaction costs and speeds up the process, making digital currencies more accessible and practical for regular use.

Fiat-backed stablecoins like USDT and USDC are linked to traditional fiat currencies. They act as a digital equivalent of the fiat currency, offering a stable medium of exchange compared to other volatile cryptocurrencies.

Key Features:

- Pegging Mechanism: Their value is anchored to real-world currencies (e.g., USD, Euro), backed by currency reserves.

- Functionality: They work like an IOU – users exchange fiat currency for stablecoins, redeemable later.

Advantages Over Traditional Currencies:

- Stability: They maintain a constant value, unlike traditional cryptocurrencies.

- Efficiency: Ideal for global transactions, offering cost and convenience benefits.

- Predictability: Their value reflects the stability of the fiat currency they are pegged to.

USDT (Tether): Overview

Tether (USDT), the oldest and largest US dollar-pegged stablecoin, entered the crypto industry in 2014. Developed by Tether Limited Inc., USDT was introduced to provide investors with a stable investment option amidst the volatile crypto market. Its market presence has been significant, capturing a considerable share in the crypto market since its inception.

USDT’s primary feature is its stability, being pegged to the US dollar. This pegging mechanism aims to ensure a consistent market value. As of 2021, Tether ranked as one of the biggest cryptocurrencies worldwide and is recognized as a prominent stablecoin, with a market supply surpassing $86 billion.

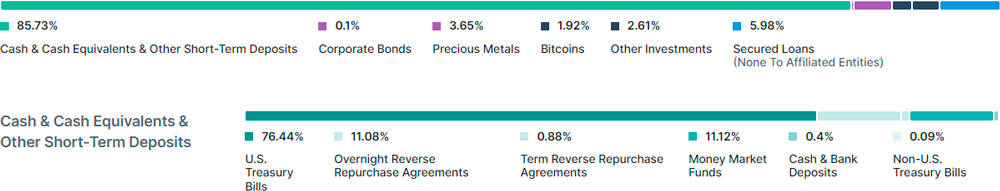

Tether has faced notable legal and transparency challenges. Criticisms have been directed towards its claim of 1:1 backing with US dollar reserves, with a lack of independent audits raising questions over its operations. Legal issues include scrutiny from regulatory bodies like the Commodity Futures Trading Commission, which imposed a significant fine on Tether for not being fully backed during certain periods.

USD Coin (USDC): Overview

Launched in 2018, USD Coin (USDC) is a collaboration between Circle and Coinbase. Created by the Centre Consortium, USDC serves as an alternative to other USD-backed cryptocurrencies, offering tokenized US dollars for easier use in digital transactions.

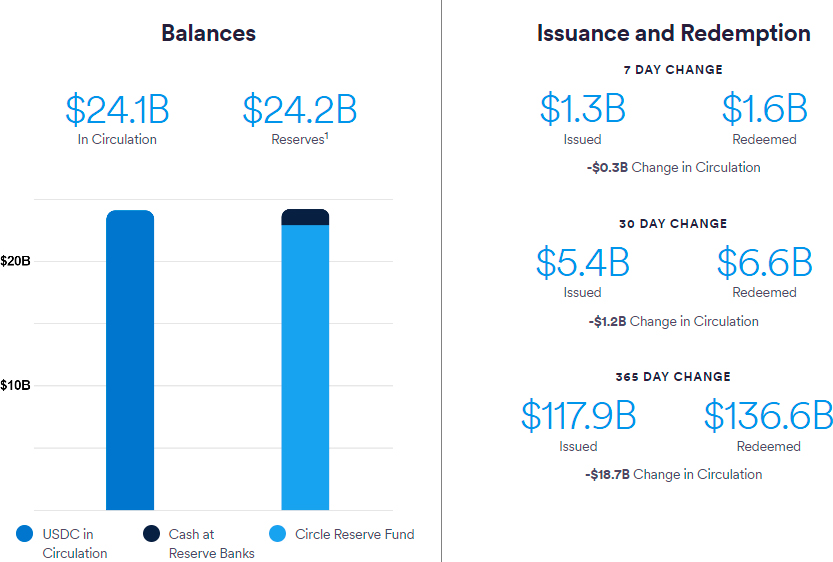

USDC is known for its stability, pegged to the US dollar. It prioritizes transparency and regulatory compliance, crucial for maintaining credibility as a stablecoin. Regular audits are conducted to ensure that each token is backed by a corresponding US dollar held in reserve. USDC is regulated under state money transmission laws, adding an extra layer of trustworthiness.

USDC has seen a growing trend in adoption, both in the US and globally. As of 2023, it continues to trade near parity with the US dollar, showcasing its stability in the volatile world of cryptocurrencies. The adoption of USDC has been increasing, positioning it as a significant player in the digital asset market.

Comparative Analysis: USDC vs USDT

Both USDT (Tether) and USDC (USD Coin) are stablecoins, sharing the fundamental purpose of providing stability in the volatile crypto market. They are pegged to the US dollar, ensuring a consistent value relative to the fiat currency. This pegging makes them suitable for investors and users seeking to avoid the typical cryptocurrency market fluctuations.

Key Differences

- Operational Transparency: USDC, issued by Centre Consortium, is valued for its transparency. In contrast, USDT, issued by Tether Limited, has faced criticism over the lack of independent audits of its dollar reserves.

- Reserve Management: USDC’s reserves are regularly audited, ensuring that each token is backed by a corresponding US dollar. USDT, while also backed by the US dollar, has faced scrutiny regarding the verifiability of its reserves.

- Market Dynamics: USDT has a higher trading volume and liquidity, making it the most traded cryptocurrency. USDC, although preferred for its transparency, faced a depegging issue in March 2023, leading to shifts in investor preferences.

| Aspect | USDT | USDC |

|---|---|---|

| Launched | 2014 | 2018 |

| Issuer | Tether Limited | Centre Consortium (Circle and Coinbase) |

| Pegged to | US Dollar | US Dollar |

| Market Presence | Most traded cryptocurrency, higher liquidity | Growing adoption, especially among institutional investors |

| Transparency and Audits | Criticism for lack of independent audits | Regular audits, higher transparency |

| Legal Challenges | Legal and regulatory scrutiny | Regulated under state money transmission laws |

| Adoption Trends | Widely used, preference shifted post March 2023 depegging | Increasing use in cross-border payments |

Impact on Traders and Investors

Stablecoin transaction fees are significantly lower than standard transactions, benefiting traders and investors. In 2021, transfers involving USDC and USDT reached $3 trillion, indicating their substantial impact on the crypto market. The average transaction size for USDC tends to be greater than USDT, which might reflect its growing popularity among institutional investors.

Benefits and Challenges

USD stablecoins, predominantly USDC and USDT, are integral in international transactions. Their pegging to the US dollar offers a reliable and efficient alternative to traditional payment methods. This influence is particularly significant in the crypto capital markets, where these stablecoins serve as a base currency for trading in and out of more volatile crypto assets like Bitcoin or Ethereum.

Benefits: Stablecoins like USDC and USDT enable fast and efficient cross-border transactions. They are increasingly becoming the standard for remittances, payments, and international trade due to their speed, efficiency, and reduced transaction fees.

Challenges: Despite their benefits, stablecoins face various challenges, such as regulatory hurdles, technical complexities, and the need for widespread adoption to be effective. They are also vulnerable to security risks like hacking.

Assessing Safety and Stability in Stablecoins

Stability in stablecoins like USDT and USDC is influenced by their stabilization mechanisms and the assets backing them. While many stablecoins are pegged to the same real-world assets, their approaches to maintaining stability can vary significantly, impacting their reliability. For instance, the collapse of UST in May 2022 highlighted the fragility of algorithmic stablecoins and underscored the need for credible collateral in fiat-linked stablecoins.

Reserve assets backing stablecoins, which could include fiat currencies, traditional financial assets, or digital assets, play a pivotal role in assuring users of the stablecoin’s reliability. Regulatory compliance is also a crucial factor, as it assures that issuers have the necessary funds to redeem stablecoins at par on demand. The lack of standardized reserve assets and compliance with banking laws are often points of concern and scrutiny.

USDT Reserve Breakdown

USDC Reserves Breakdown

Final Thoughts and Future Outlook

The landscape of stablecoins, including key players like USDT and USDC, is continually evolving. With advancements such as Circle’s v2.2 upgrade for USDC, efforts are being made to enhance the utility, security, and user experience of stablecoins. However, challenges persist, such as maintaining the peg ratio, which is crucial for the credibility of fiat-backed stablecoins like USDT and USDC.

For crypto users and investors, understanding the nuances of stablecoins like USDT coin and USDC stablecoin is crucial. Weighing the pros and cons, including factors like stability and liquidity, is essential before investing. While stablecoins offer certain advantages over other cryptocurrencies, users must stay informed about developments in the sector to make strategic decisions. The role of stablecoins in the broader crypto and financial markets, especially in the context of tether vs USDC, will likely continue to be a topic of interest and debate

FAQ

While USDT (Tether) and USDC (USD Coin) are both digital currencies anchored to the US Dollar, they have distinct operational characteristics. USDT is managed by Tether Limited and has been subject to scrutiny regarding its transparency. On the other hand, USDC, created by the Centre Consortium (Circle and Coinbase), is noted for its consistent audits and clear operational procedures. USDT often leads in market volume and liquidity, whereas USDC is increasingly recognized for its adherence to regulatory standards and is becoming a preferred choice for international transactions.

The cost of transferring USDT versus USDC varies, mainly depending on the blockchain network and the transaction platform. Typically, USDT might incur relatively higher fees on certain networks, attributable to its extensive market presence and liquidity. Conversely, USDC often presents more economical transaction fees, particularly on networks optimized for stablecoin operations. It’s advisable to verify the latest fees on your chosen platform and network to get an accurate fee comparison.

USDT’s reliability is closely tied to its backing reserves and the openness of its financial operations. Although USDT is a prominent stablecoin with substantial market usage, past concerns over its auditing transparency have prompted questions about its overall security. Nevertheless, USDT continues to be a major stablecoin choice for a wide range of crypto activities.

USDC is often regarded as a secure stablecoin, thanks to its regular financial audits and high level of transparency. Backed by fiat currency reserves and regulated under United States state money transmission laws, USDC has established a reputation for reliability and safety in the cryptocurrency domain. Its commitment to regulatory compliance and transparency has strengthened its standing as a trusted stablecoin option in the crypto market.