Non-Fungible Tokens (NFTs) are unique digital assets verified using blockchain technology, ensuring the authenticity and ownership of digital items ranging from art to collectibles. They have been around for a while but only recently garnered widespread attention.

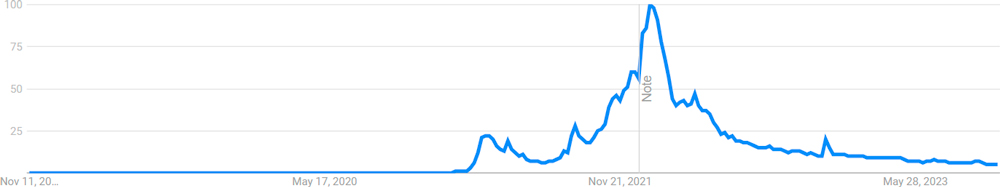

The phenomenon of NFTs took off around mid-2020, reaching a significant milestone in March 2021 with the sale of a digital artwork by Beeple for a staggering $69.3 million at Christie’s auction house. This event propelled NFTs into the mainstream, capturing the imagination and investment of a broader audience.

In 2020, the NFT market was relatively modest, but by the end of 2021, it exploded into a $40 billion market, a stark contrast to the beginning of 2021 when only a niche group of crypto enthusiasts were familiar with NFTs. The market experienced a remarkable surge, especially in the second quarter of 2021, with sales shooting up to $2.5 billion from merely $13.7 million in the first half of 2020. The demand for NFTs saw a stratospheric rise, with the market cap growing by 1,785% in 2021. The number of wallets trading in NFTs expanded significantly from around 545,000 in 2020 to about 28.6 million in 2021, underscoring the massive adoption and the booming popularity of NFTs.

With such an astronomical rise, it’s natural to encounter skepticism and questions about the sustainability and the future of NFTs. The phrase “Are NFTs Dead” encapsulates the concerns many have regarding the vitality and longevity of the NFT market. This article afims to delve deeper into these concerns, analyzing various factors that could influence the trajectory of NFTs, and whether the hype surrounding them has died down or if NFTs continue to be a robust and evolving digital asset class.

Table of contents

The “NFT Winter” of 2023

The phrase “NFT Winter” mirrors a chilling period in the Non-Fungible Tokens (NFTs) market, akin to the crypto industry’s bearish phases. This term symbolizes a noticeable downturn post the NFT boom of 2020 and 2021.

Market Downturn and its Impacts

By mid-2023, the vibrant NFT market began facing harsh winds. A substantial value drop in many tokens was witnessed, with some NFTs losing up to 90% of their worth, leading to hefty losses for investors.

Key factors fueling this downturn included:

- Oversaturation: The market brimmed with NFTs, diluting the unique value of many tokens.

- Speculation: Market driven more by short-term profit-seekers than genuine collectors.

- Regulatory Concerns: Global legal bodies zoomed in on NFTs, raising legal and tax red flags.

- Lack of Utility: Beyond being collectibles, many NFT projects lacked real-world application.

- Sustainability Concerns: Environmental debates, especially around Ethereum-based NFTs, turned some artists and collectors away.

This chilling period brought about:

- Losses: A financial downslide for investors.

- Reevaluation: Artists and creators reconsidered NFTs’ role in their work.

- Market Maturation: A needed growth and reflection period for the NFT market.

- Continued Innovation: Despite the chill, novel and eco-conscious projects found their footing.

Additionally, a slump in average NFT transactions per wallet was observed, as the market lagged behind other crypto and traditional assets. Brands began eyeing customer loyalty programs as a new NFT frontier, hinting at a market reassessment.

Signs of Resilience

The Bored Ape Yacht Club (BAYC), a prime example, has maintained a strong foothold. Over the last week alone, BAYC NFTs were traded 469 times, generating a total sales volume of $24.47 million. The average price per BAYC NFT stood at $52.2k, highlighting sustained interest and value in select NFT collections. Remarkably, specific BAYC NFTs fetched astounding prices, for instance, Bored Ape #3749, known as “The Captain,” sold for $2.91 million, while Bored Ape #1837, adorned with solid gold fur, garnered $1.55 million.

Moreover, a blend of NFTs with brand identity is unfolding. Brands like Nike and Reddit have integrated digital collectibles (NFTs) into their offerings, enhancing brand awareness and revenue generation. In a strategic move, Polygon Studios partnered with Starbucks to launch the Odyssey loyalty program based on NFTs, heralding a shift towards leveraging NFTs for customer loyalty and engagement.

Opinions on the Future of NFTs

Award-winning journalist Cherie Hu believes that the “NFT ecosystem is still being led by independent artists” who are pioneering new use cases for the technology. Hu emphasizes the potential of technologies beyond NFTs, like artificial intelligence (AI), to significantly impact the creative industry. She sees a future where friction in manifesting creative ideas is substantially reduced, thanks to these technologies.

On a similar optimistic note, Brendan Playford, a longtime blockchain proponent and co-founder of Masa Finance, sees the potential for novel blockchain and NFT technologies to significantly impact industries beyond the creative realm. He mentions Soulbound Tokens (SBTs), a new form of NFT utility, as an example of innovations that could accelerate mainstream adoption of NFTs, especially among younger generations.

On the other hand, some experts point towards a more cautious outlook. According to a PwC report, trust-building is a crucial step for digital asset companies to impress a broader audience including customers, investors, and regulators.

Differing Viewpoints

The differing viewpoints hinge on various factors like the level of understanding and acceptance among the general populace, the rate of technological advancements, and the adaptability of the market. A Morning Consult study highlighted by Just Creative, revealed that only one in four Americans knows what an NFT is, indicating a significant awareness gap despite the ongoing improvements and popularity in digital art.

Moreover, the Nasdaq points out that NFT platforms with staying power are those experimenting with utilities around their collections, indicating a trend towards functional utility as a key to long-term viability

Wraping Up

In conclusion, the journey of NFTs mirrors the dynamic evolution of blockchain technology, each step heralding new potentials and challenges. The current landscape showcases a blend of optimism and caution, a reflection of the broader blockchain realm. The kaleidoscopic nature of NFTs has painted various sectors with shades of innovation, hinting at a future ripe with possibilities. As we stand at the cusp of digital renaissance, it’s an open invitation for readers to delve deeper, follow the rhythmic dance of NFTs and blockchain, and be part of a narrative that’s unfolding with every tick of the clock. Your cue to explore couldn’t be more enticing!