The Bitcoin network’s computational might has recorded a historic peak, surpassing 540 exahashes per second (EH/s) this Christmas. Despite this milestone, miners face a paradox as profitability takes a dip.

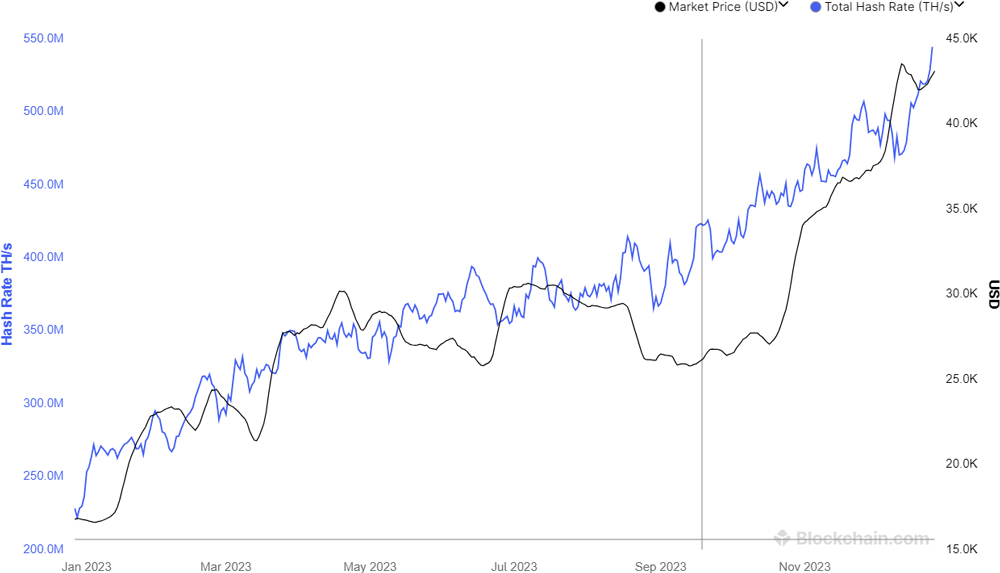

On December 25th, data from Blockchain.com highlighted this unprecedented surge, with Bitinfocharts corroborating an average weekend spike. This year alone, the network’s hash rate has impressively doubled, marking a 130% growth since January.

While the hash rate—a measure of mining power — escalates, mirroring this surge, Bitcoin’s value has also soared by over 150% since the year’s start. Will Clemente of Reflexivity Research, examining these figures on a logarithmic scale, downplayed the impact of China’s 2021 mining ban, emphasizing the resilience of what he terms “the most secure decentralized open-source monetary network.”

However, the current scenario presents a double-edged sword. A robust hash rate typically suggests a healthy network but also implies increased difficulty for miners in earning new blocks. The hash price, an indicator of mining profitability, has seen a decline to $0.09 per terahash per second per day, as reported by HashrateIndex.

Since December 17th, profitability has seen a 34% reduction, influenced by the cooling of the BRC-20 ordinal inscription demand. Glassnode analyst “Checkmatey” notes the persistent congestion in Bitcoin’s mempool since February, pointing to sustained fee pressure.

Despite crossing the 500 EH/s threshold in late November, miners are now navigating through the complexities of a robust yet challenging mining landscape.