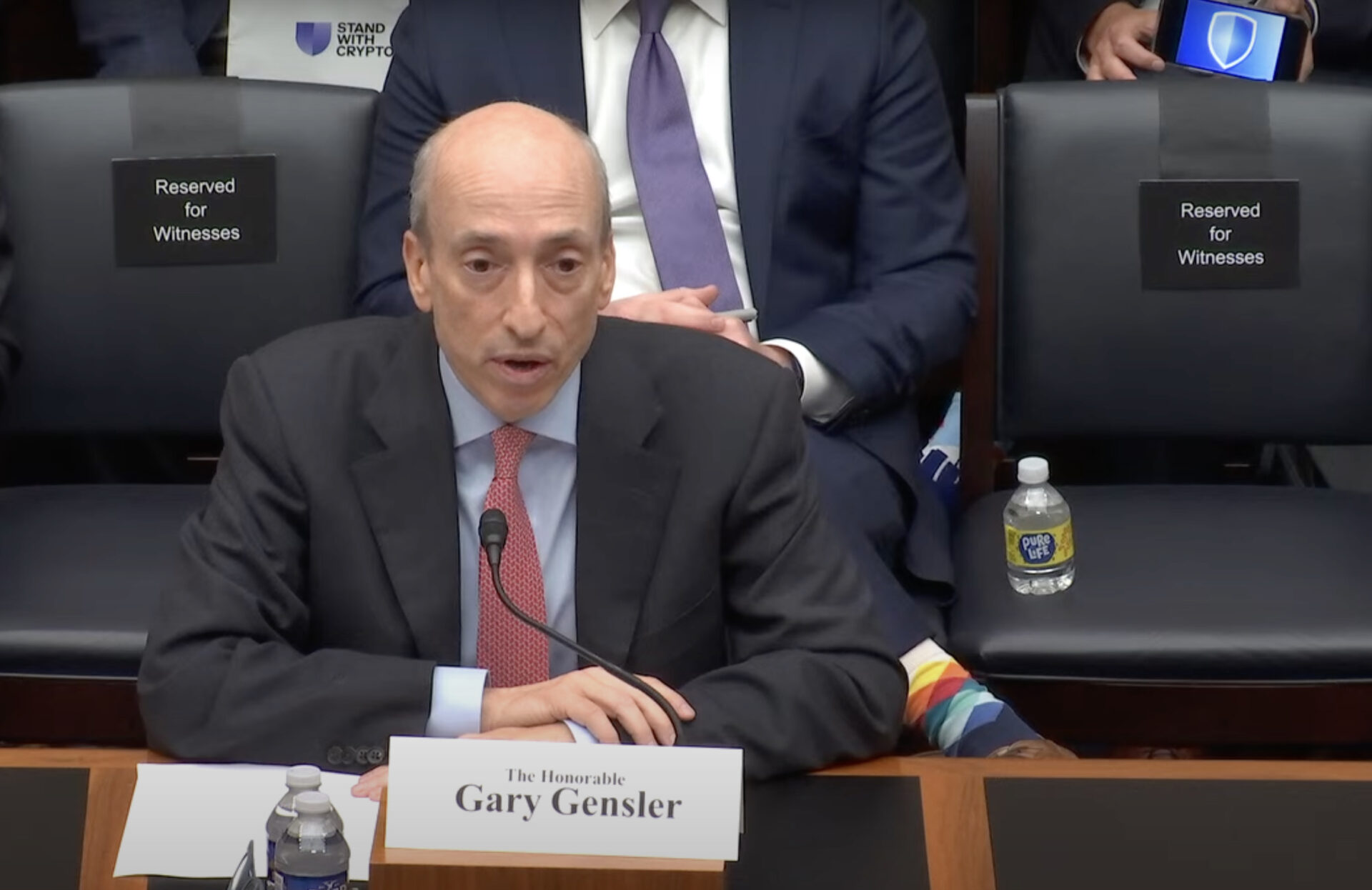

In the ever-evolving landscape of cryptocurrency regulations, the U.S. Securities and Exchange Commission (SEC) finds itself at the center of attention, particularly its chairman, Gary Gensler.

The Controversy Surrounding SAB 121

In March 2022, the SEC unveiled the Staff Accounting Bulletin 121 (SAB 121), emphasizing accounting protocols for crypto funds retained by platforms like Coinbase and Robinhood. This initiative has garnered significant industry feedback.

Gensler’s Defense and the Underlying Issues

Gensler confirmed that SAB 121 reflects existing SEC rules, but Flood pointed out the absence of clear SEC guidelines on digital asset custody during its release, raising questions about the SEC’s intent. SAB 121’s requirements for public entities to disclose challenges related to digital asset protection faced resistance.

Notably, SEC commissioner Hester Peirce voiced concerns, and senators, including crypto supporter Cynthia Lummis, labeled the bulletin as “covert regulation posed as guidance.”

The Broader Implications for the Crypto Industry

The ripple effects of SAB 121 extend beyond just accounting standards. The bulletin’s release has sparked debates on other related topics, such as the approval of spot Bitcoin exchange-traded funds (ETFs). While some committee members urged Gensler to greenlight these ETFs, the topic wasn’t extensively discussed during the hearing.

Gensler’s position on Grayscale’s Bitcoin ETF application, initially declined by the SEC, gained significant attention. Even though Grayscale successfully challenged the decision, the SEC’s conclusive judgment is still actively being deliberated.

The House Financial Services Committee hearing underscores the complexities and challenges of regulating the dynamic crypto industry. As the SEC and its chairman, Gary Gensler, navigate these regulatory waters, the crypto community and stakeholders await clear, fair, and forward-looking guidelines that can foster growth while ensuring investor protection.