In the world of cryptocurrencies, the phenomenon of crypto pump and dump schemes is prevalent and poses significant risks. These schemes are orchestrated by crypto pump and dump groups, often utilizing social platforms like Discord and Telegram. In these groups, there is typically a hierarchical structure where top members get early information about planned pump and dump activities. These insiders buy the asset at a low price and sell it at a high price before the price collapses, leaving other investors at a loss.

There are different types of pump-and-dump groups: transparent and obscure. Transparent groups are open about their activities, often using terms like “pump” and “dump” in their communications. In contrast, obscure groups avoid direct references to such activities, making it harder for members to discern the true nature of the group.

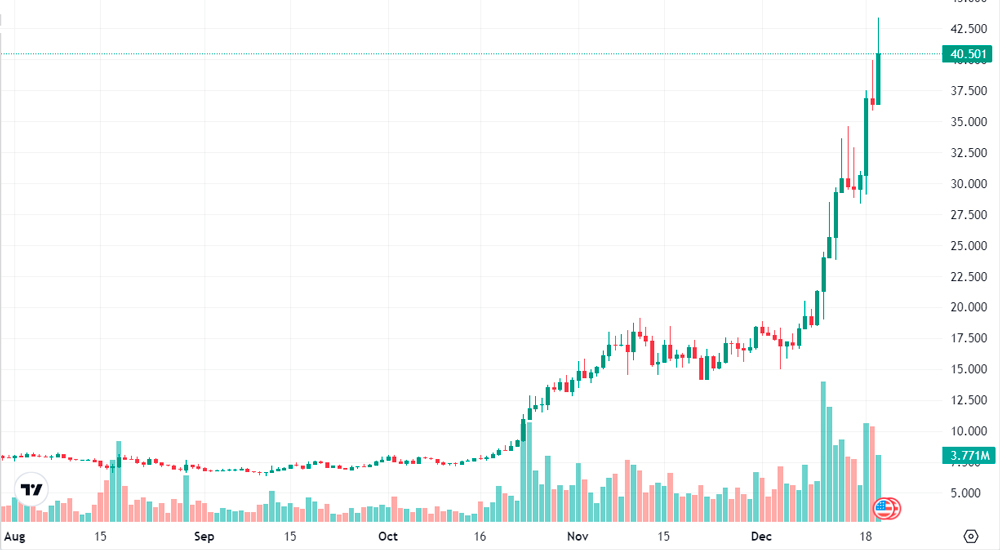

One notable example of a crypto pump-and-dump scheme was the dramatic rise and fall of a token inspired by the TV series “Squid Game,” which surged 2,400% and then collapsed after the developers vanished with the funds. This type of scam is often referred to as a “rug pull”.

To protect yourself from falling victim to these schemes, it’s essential to:

- Conduct thorough research on any cryptocurrency project you consider investing in.

- Be skeptical of offers that seem too good to be true.

- Be cautious about sharing personal and financial information.

- Diversify your investments across various projects and coins.

Table of contents

Understanding Crypto Pumps

Additionally, it’s crucial to understand that while crypto pump-and-dump schemes share similarities with traditional stock market manipulation, there are differences, primarily due to the unregulated nature of the cryptocurrency market. While these schemes are illegal in the stock market, the legal status of such activities in the crypto market is more ambiguous, often falling into a legal grey area.

Crypto pump and dump groups leverage various strategies like organized group activities, chatroom rumors, celebrity endorsements, and social media hype to manipulate market prices. The surge in price is followed by a rapid sell-off by the orchestrators, leading to a price crash. This raises the question among some investors, “where can I join a crypto pump,” not realizing the potential risks and legal implications involved.

Real-world examples like Bitconnect, the GameStop short squeeze, and Dogecoin hype illustrate the risks of market manipulation and underscore the importance of cautious investment and understanding the fundamentals of assets before trading.

It’s important to remember that engaging in price manipulation is illegal and unethical. Regulatory bodies like the SEC actively pursue individuals involved in such activities, and the consequences can be severe.

Telegram Groups for Crypto Pumps

- Crypto Pump Club: A large Telegram group with over 57,000 subscribers offering weekly Binance and Huobi pump signals. Some signals are free, but a paid VIP group is available for more frequent signals.

- Mega Pump Group: Manages pumps on Binance and offers information for free to its 50,000+ subscribers.

- Big Pump Signal: Boasts over 70,000 members on Telegram and up to 200,000 on Discord, coordinating cryptocurrencies on Binance.

- Big Pump Group: Similar to Big Pump Signal, operates on Binance.com and Kucoin.com with an affiliate program.

- Verified Crypto Traders: Known for its interactive experience and expert-led trading signals.

- Universal Crypto Signals: Established in 2018, offers a variety of crypto signals with high accuracy.

- Learn2Trade: Provides daily signals, market trend analysis, and trading courses.

- Crypto Pump Island: Known for its active involvement in crypto pump and dump strategies, offering regular updates and discussions on potential targets.

Discord Servers for Crypto Pumps

Discord servers, much like Telegram groups, are pivotal in the coordination and discussion of crypto pump and dump schemes. These servers offer a platform for real-time communication among participants, where strategies and specific cryptocurrency targets are discussed. They also provide a sense of community for those involved in these activities. Discord servers can range from public forums open to anyone to more exclusive, member-only groups that require an invitation or membership fee.

- Cryptohub: A community focused on cryptocurrency market analysis and potential pump opportunities.

Crypto Pump Apps

- Crypto Pump Finder: An app that features tracking and alerts to help identify potential pump and dump activities.

It’s important to approach these groups and platforms with caution as they involve high risk and potential legal and ethical issues. The nature of pump and dump schemes often leads to financial losses for many participants. Always conduct thorough research and understand the risks before engaging in any investment activity, especially in volatile markets like cryptocurrency.

Risks of Joining

Financial Loss: Investors are often lured into these schemes with the promise of quick profits. However, most participants end up facing substantial losses, especially when they buy at inflated prices and can’t sell off before the dump occurs.

Market-wide Impact: These schemes can harm the broader cryptocurrency market’s reputation, potentially slowing overall growth and deterring new investors. Market manipulation affects many other cryptocurrencies and can lead to reduced value for credible coins.

Legal Consequences: While crypto pump and dump schemes may not always be explicitly illegal due to the unregulated nature of many cryptocurrencies, they are generally considered unethical and akin to fraud. In some jurisdictions, involvement in these schemes could lead to severe legal consequences, including fines and imprisonment.

Regulatory Responses: The prevalence of pump and dump schemes in the crypto market has prompted regulatory bodies to consider stricter regulations, which could impact the evolution of blockchain technology and cryptocurrency innovations.

Red Flags to Spot Pump and Dump Schemes

- Sudden Price Spikes: Be wary of unexpected, significant price increases in low-volume cryptocurrencies, which could indicate a pump and dump scheme.

- Aggressive Marketing and Unsubstantiated Claims: Excessive promotional activities and unrealistic promises about a cryptocurrency’s potential returns are common tactics used by pump groups.

- Lack of Fundamental Value: If a cryptocurrency’s price surge seems disconnected from any substantial development or utility, it might be part of a pump and dump scheme.

Protecting Yourself

- Research and Due Diligence: Always conduct thorough research on any cryptocurrency investment and assess its legitimacy and potential value.

- Diversify Your Portfolio: Spreading your investments can mitigate risks associated with individual cryptocurrencies.

- Stay Informed and Skeptical: Keep up with market trends and news, and verify information from multiple reliable sources.

Alternatives to Crypto Pump and Dump

For individuals seeking alternatives to risky and often unethical crypto pump and dump schemes, there are several legitimate investment strategies in the cryptocurrency market that focus on research, long-term planning, and leveraging educational resources. These methods emphasize the importance of knowledge in crypto trading and aim to provide more stable and ethical ways to participate in the market.

- Dollar Cost Averaging (DCA): This strategy involves investing a fixed amount into a cryptocurrency at regular intervals, regardless of its price. This method helps to mitigate the impact of volatility and can result in a lower average cost per share over time. Platforms like eToro offer automated DCA services for convenience.

- Copy-Trading Whales: Following the trades of large-scale investors or ‘whales’ can be beneficial. However, it requires careful selection of whom to copy, as their strategies might not always align with your investment goals. Tools like Whale Alert or ClankApp can help track major investors’ activities.

- Fundamental Analysis: This approach involves evaluating a cryptocurrency’s underlying factors like technology, development team, market demand, and regulatory environment. It focuses on long-term value and growth potential rather than short-term price movements.

- Technical Analysis and Trading Bots: For those interested in more active trading, technical analysis and the use of automated trading bots can be effective. These tools analyze market data and execute trades based on predefined rules and criteria.

- Value Investing: Much like traditional markets, this strategy involves identifying undervalued cryptocurrencies that you believe have a higher intrinsic value than their current market price.

- Yield Farming and NFTs: Involving decentralized finance (DeFi) protocols, this strategy maximizes yields by staking or providing liquidity. NFT trading also offers an opportunity for those with an interest in digital assets.

- Educational Resources: Leveraging educational resources is crucial for informed investing. This includes staying updated with market trends, understanding the technology behind cryptocurrencies, and learning from credible sources.

In conclusion, while the allure of quick gains from crypto pumps can be tempting, and you might find yourself asking “where can I join a crypto pump,” these alternative investment strategies provide a more sustainable and ethical approach to crypto investing. It’s important to assess your risk tolerance, investment goals, and conduct thorough research before diving into any investment strategy. Remember, a well-informed and cautious approach is key in the dynamic and often unpredictable cryptocurrency market.