In the dynamic world of cryptocurrency trading, Bybit and KuCoin stand out as two formidable platforms. Bybit, established in 2018 in Seychelles by Ben Zhou and Duan Xinxing, has swiftly climbed the popularity ladder. Known for its strong focus on futures and margin trading, Bybit offers a daily trading volume surpassing $1.7 – $2.3 billion as of 2023. It’s celebrated for its advanced trading bots and an extensive range of order types, catering to a diverse trading community.

Conversely, KuCoin, rooted in Hong Kong and founded a year earlier in 2017 by Michael Gan and Eric Don, has also carved its niche in the market. With a daily trading volume of over $700 million – $1.6 billion, KuCoin’s edge lies in its support for a broader array of currencies and multiple payment methods. This platform is particularly favored for its user-friendly interface and commendable customer support.

Both platforms have garnered significant acclaim in the crypto trading community, with Bybit priding itself on a clean security record and KuCoin recovering impressively from a significant security breach in 2020. Bybit’s layered security protocols and KuCoin’s enhanced security measures post-breach speak volumes about their commitment to user safety.

Navigating the complex landscape of crypto exchanges, Bybit and KuCoin emerge as prominent players. Each platform, with its unique offerings, caters adeptly to a diverse user base, from novices to trading veterans. Here, we dissect the features of each, providing insights pivotal for anyone weighing Bybit or KuCoin for their crypto endeavors.

Table of contents

Platform Features and User Interface

Navigating the complex landscape of crypto exchanges, Bybit and KuCoin emerge as prominent players. Each platform, with its unique offerings, caters adeptly to a diverse user base, from novices to trading veterans. Here, we dissect the features of each, providing insights pivotal for anyone weighing Bybit or KuCoin for their crypto endeavors.

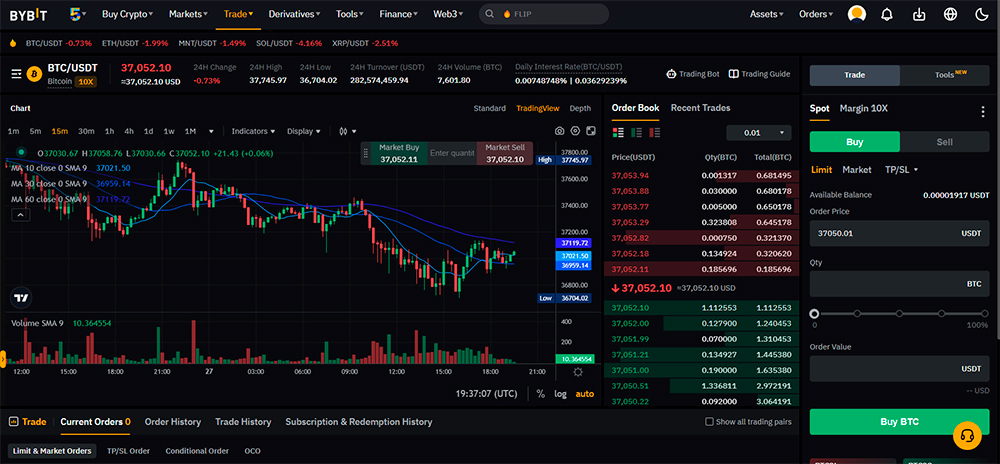

Bybit Features

- Derivatives Trading: Known for its derivatives market, Bybit presents an extensive range, including numerous contracts and options, with some offerings enabling up to 100x leverage. This aspect is a critical consideration in the Bybit vs KuCoin futures debate.

- Options Trading: With its acclaimed USDC options marketplace, Bybit leads in this domain, supported by a potent transaction processing system.

- Innovative Bybit Earn Program: Bybit unfolds a spectrum of earning strategies, allowing users to maximize their crypto holdings through various programs.

- Intuitive User Interface: Accessibility is key at Bybit, with a user-friendly web and mobile app interface, ensuring an efficient and secure trading experience.

- Advancing with Bybit Blockchain: While specific details were sparse, Bybit’s integration with web3, especially through its multi-functional wallet, marks its significant stride in blockchain technology.

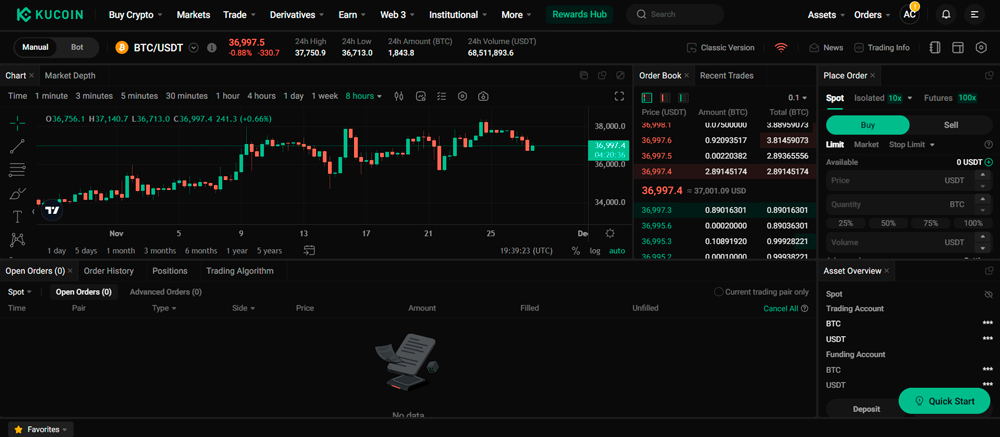

KuCoin’s Features

- Expansive Cryptocurrency Range: With over 700 cryptocurrencies, KuCoin caters to a wide market, a factor to consider in the kucoin vs bybit analysis.

- Futures Trading Edge: KuCoin’s futures market is substantial, offering a broad array of contracts, a key element in the bybit vs kucoin fees comparison.

- Diverse KuCoin Earn Program: This program offers structured and professionally managed earning strategies, adding value to the user’s crypto journey.

- Simplified User Interface: KuCoin’s interface, both on web and mobile platforms, is lauded for its user-centric design, enhancing the overall trading experience.

- Web3 Integration with KuCoin Chain: The Halo wallet exemplifies KuCoin’s foray into the web3 domain, blending security with advanced blockchain technology.

A Trader’s Perspective

- Trading Diversity: Both platforms offer an array of trading options, with Bybit leaning more towards derivatives and options, while KuCoin offers a broader cryptocurrency selection.

- Ease of Use: Both Bybit and KuCoin prioritize user-friendly interfaces, ensuring seamless trading experiences.

- Security and Blockchain Technology: Each platform’s commitment to security is evident, with KuCoin’s Halo wallet being a standout feature for web3 integration.

Security Comparison

Bybit’s Security

Bybit has established itself as a secure cryptocurrency exchange, implementing several robust measures to protect user information and funds. These include:

- Multi-Signature Wallet System: This system is utilized for user funds, adding an extra layer of security.

- High-End 2FA: Two-factor authentication is rigorously applied, especially for mobile app access.

- Advanced Encryption: To safeguard data against unauthorized access.

- Withdrawal Whitelisting: An added measure to control fund withdrawal.

- Insurance Funds: Providing a safety net against unforeseen events.

- Periodic Security Audits: To continuously evaluate and enhance security protocols.

KuCoin’s Security

KuCoin, while prioritizing security, has experienced significant cyberattacks in the past. The platform’s response and recovery efforts demonstrate its commitment to user safety:

- KYC Protocols: Employed to prevent fraudulent activities and facilitate quick account recovery.

- 2-Factor Authentication: A critical layer in securing user accounts.

- Bank-Level Encryption: Ensuring data and transaction security.

- Cold Wallet Storage: Most assets are stored offline for added security.

- Unique Trade Passwords: Users can set up additional passwords for transactions.

- Safeguard Program: An alliance focused on cybersecurity and support in the event of cyberattacks.

- Customer Support: Available 24/7 to address security concerns.

Fee Structure

Bybit’s Fee Model

- Spot Trading Fees: Bybit charges a competitive 0.1% fee for both makers and takers in spot trading. This rate can be reduced for high-volume traders who attain different VIP levels, enhancing cost efficiency for active traders.

- Futures Trading Fees: For those engaging in perpetual contracts or futures, Bybit begins its fees at 0.02% for makers and 0.055% for takers, aligning with industry standards.

- Derivatives Trading Fees: Options trading on Bybit starts at 0.03% for both makers and takers, offering a uniform fee structure for this trading segment.

More about ByBit fee model read here.

KuCoin’s Fee Model

- Spot Trading Fees: KuCoin provides a base fee of 0.1% for both market makers and takers in Class A cryptocurrencies, with a tiered fee structure that decreases fees based on transaction volume or KCS token holdings. For Class B and C cryptocurrencies, the fees are slightly higher at 0.16% and 0.24%, respectively.

- Futures Trading Fees: KuCoin’s futures trading fees differ based on the trader’s role as a maker or taker and their VIP level, though specific rates are not detailed in the source.

- Derivatives Trading Fees: Leveraged token trading on KuCoin does not involve margin maintenance fees, and these tokens have a 3x multiplier, making them a distinct offering in the market.

More about KuCoin fee model read here.

Bybit vs KuCoin Fees

When comparing Bybit vs KuCoin fees, it’s evident that both platforms strive to offer competitive rates. Bybit’s straightforward fee structure for spot and derivatives trading is appealing for its simplicity. In contrast, KuCoin’s tiered approach to spot trading fees offers cost efficiency and incentives for higher trading volumes and KCS token holders. This tiered system is particularly noteworthy in the fee comparison, as it provides a path for reducing trading costs for active users.

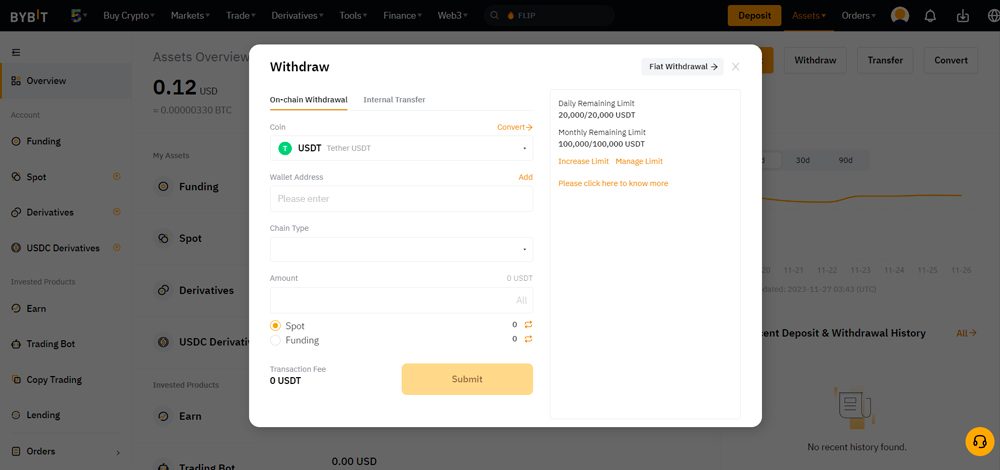

Deposit and Withdrawal Methods

Bybit’s Deposit and Withdrawal Methods

- Supported Deposit Methods: Information on Bybit’s specific deposit methods was not detailed in the sources reviewed.

- Withdrawal Options and Limitations: Details regarding Bybit’s withdrawal options and any associated limitations were not available in the sources.

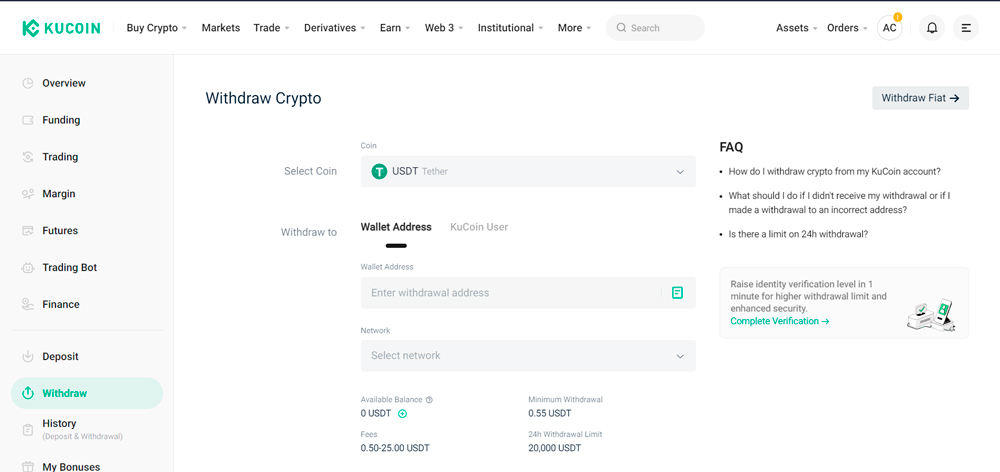

KuCoin’s Deposit and Withdrawal Methods

- Supported Deposit Methods: KuCoin supports a range of deposit methods, catering to a global user base with various payment preferences. However, specific methods were not detailed in the sources.

- Withdrawal Options and Limitations: KuCoin’s withdrawal options vary based on the cryptocurrency, with fees differing to account for network costs. The platform does not charge deposit fees, making it accessible for users starting their crypto journey.

Pros of Bybit

- Dual Price Mechanism: Reduces the risk of unfair liquidations.

- High Leverage Potential: Offers leverage up to 1:100, enhancing profit opportunities.

- 24/7 Multilingual Customer Support: Ensures assistance is always available.

- No Trade and Withdrawal Limits: Offers flexibility for all account types.

- Market Depth and Execution: Ensures minimal price impact on trades.

- Strong Security with Cold Wallets: Enhances fund safety.

- Effective Risk Management Tools: Protects against unfavorable market fluctuations.

- High Transaction Processing Speed: 100,000 TPS per contract, reducing overload risks.

- Versatile Trading Options: Allows easy coin swaps, profit-taking, and order adjustments within accounts.

Pros of KuCoin

- Extensive Cryptocurrency List: Over 1000+ cryptos, including many low-market-cap tokens.

- Diverse DeFi and Web3 Features: Includes an NFT marketplace.

- Reputation in the Crypto World: Recognized and well-regarded platform.

- Leverage in Crypto Derivatives: Offers leveraged trading options.

- Interest-Earning Opportunities: Through crypto staking.

- Effective Customer Service: Reliable support for users.

- Competitive Trading Fees: Lower fees enhance cost efficiency.

Cons of Both Platforms

- Regulatory Status: Neither Bybit nor KuCoin is currently regulated.

- Access Restrictions: Both platforms have country-specific access limitations, including restrictions for U.S. residents.

- Complexity for Beginners: KuCoin’s proprietary platform may be complex for new users.

- Limited Educational Resources: Both platforms could benefit from more learning materials for users.

- Fiat Withdrawal Limitations: Fiat withdrawals are not possible on KuCoin.

Wrapping Up

In concluding the Bybit vs KuCoin comparison, it becomes clear that each platform possesses unique strengths. Bybit emerges as the more secure option, with its unwavering focus on safeguarding trader’s assets and providing a versatile environment that caters to both novice and seasoned traders. The platform’s competitive edge is bolstered by its robust customer support, including 24/7 live chat, which is invaluable for real-time assistance.

However, KuCoin stands out for its extensive array of over 700 cryptocurrencies, offering a broader spectrum for trading. It’s particularly noteworthy for traders seeking diversity in their crypto portfolio and those interested in crypto lending and borrowing. Although its customer support is not as immediate as Bybit’s, KuCoin’s comprehensive trading experience remains a significant draw.

Overall, while Bybit is lauded for its secure and user-friendly platform, complete with competitive trading fees and a variety of coins, KuCoin appeals to those seeking a wider range of digital assets and unique features. Thus, the choice between Bybit and KuCoin hinges on individual trading preferences and priorities.