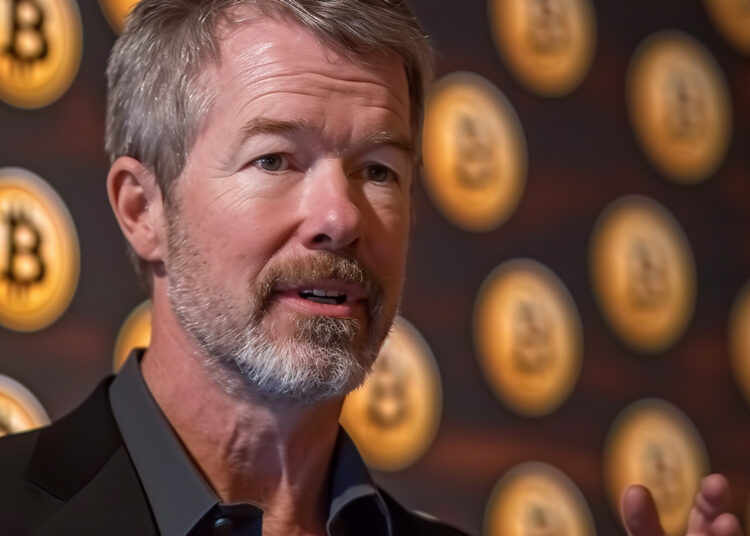

In a strategic financial maneuver, Michael Saylor, the Executive Chairman of MicroStrategy, has initiated the sale of a substantial portion of his company stock, amounting to $216 million. This move, disclosed in a recent SEC filing, is part of a deliberate plan to expand his Bitcoin portfolio.

Starting January 2nd, Saylor embarked on the sale of his stock options, which he first acquired in April 2014, and are set to expire by the end of April 2024. The first segment of the sale involved 5,000 shares, with the intention to continue this trend daily over the next four months.

During MicroStrategy’s Q3 earnings call, Saylor articulated his dual-purpose strategy:

- Addressing personal financial commitments

- Acquiring additional Bitcoin

Despite the sale, Saylor emphasized his remaining shareholdings continue to be substantial, signaling his enduring commitment to the company’s success.

MicroStrategy’s trajectory has been noteworthy, with its value surging by 411% over the last year, outstripping Bitcoin’s own impressive 170% rally. The company’s aggressive investment in Bitcoin has not waned, with a recent acquisition of 14,620 Bitcoin for $615 million, bringing its total holdings to a remarkable 189,150 Bitcoin.