With the rapid rise and fall of various cryptocurrencies, it’s easy to get lost in the whirlwind of information. Solana, once hailed as a game-changer in the blockchain world, has faced its share of ups and downs. This section delves into Solana’s journey, its growth in the crypto realm, and how it compares with other leading cryptocurrencies. Through a clear and simple lens, we’ll explore whether the claims of “Solana is dead” hold any water or if they’re just part of the ever-changing crypto narrative.

Table of contents

Solana’s Rise and Current Market Position

From its early days, Solana promised unparalleled speed and scalability, setting it apart from its contemporaries. But with the highs, there were inevitable lows. As 2023 approached, whispers of “Is Solana dead 2023?” began to circulate, casting doubts on its market position.

However, a closer look reveals a more nuanced picture. While Solana has faced challenges, it’s essential to understand its foundational strengths and the factors that contributed to its initial rise. In comparison to other leading cryptocurrencies, Solana’s performance has been commendable, but not without its share of hiccups. The “SOL dump” or “SOL crash” as some refer to it, was a phase, but does it signify the end for Solana?

Technical Insights: Solana’s Unique Features

Designed to revolutionize the way decentralized applications operate, Solana brought to the table a blend of speed, scalability, and a unique consensus mechanism known as Proof of History (PoH). But as with any technology, it’s not devoid of challenges.

At the heart of Solana’s promise lies its unique blockchain architecture. Designed with the primary goal of housing decentralized applications that can scale efficiently, Solana emerged as a beacon of hope for many developers and investors. Unlike traditional platforms, Solana’s architecture prioritizes speed without compromising on security. But how does it achieve this?

The answer lies in its hybrid consensus mechanism. By combining the strengths of Proof-of-Stake and Proof of History, Solana can process transactions at lightning speeds, far surpassing giants like Bitcoin and Ethereum. However, this speed comes with its set of challenges. Some critics argue that Solana’s emphasis on speed might lead to potential decentralization issues in the future. The whispers of “Solana is dead” or “Sol dump” often stem from misunderstandings or oversimplifications of these technical intricacies.

Persistent System Downtime and Technical Hurdles

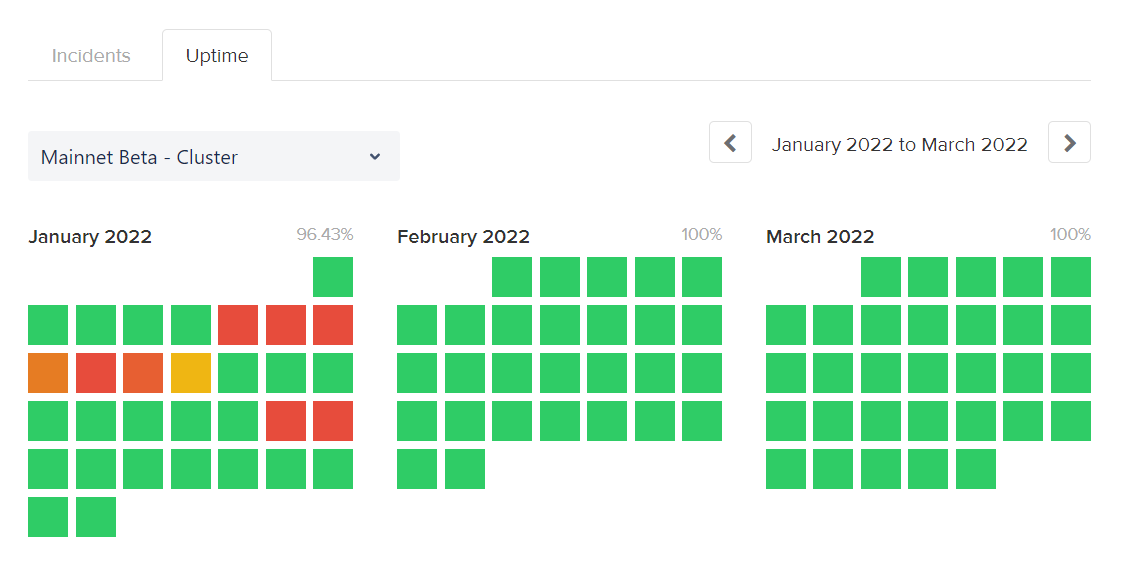

One of the most significant challenges that Solana has grappled with is system downtime. As the platform gained popularity, thanks to its impressive transaction speeds and minimal gas fees, it also saw an influx of traffic. This rapid surge, while indicative of Solana’s potential, also exposed some systemic issues.

Persistent outages, often attributed to the platform’s accelerated expansion, have raised concerns among investors and users. Questions like “Is Solana going to zero?” gained traction, especially when these outages became more frequent. The platform’s promise of breakneck speeds came under scrutiny as it struggled to manage the increased load, leading to disruptions.

The SOL Token Dynamics

The lifeblood of the Solana ecosystem is undeniably its native currency, the SOL token. Serving multiple purposes, from trading on the platform to ensuring blockchain security, the SOL token is pivotal to Solana’s operations. But with the recent “Sol dump” and market fluctuations, many are left wondering about the stability and future of this token.

Introduced in March 2020, the SOL token saw an initial release of 511 million coins. Interestingly, the Solana Foundation holds control over approximately 60% of these circulating coins, with the remaining available to users. This distribution model, while ensuring a level of stability, also raises questions about decentralization and control.

Functionally, the SOL token operates on principles similar to the Ethereum network. Users stake the token for transaction validation, leveraging the Proof-of-Stake consensus mechanism. Additionally, the token serves as a means for transaction fee payments and even reward receipts.

The Migration of Projects and Solana’s Reputation

Another pivotal factor influencing Solana’s market position has been the migration of projects from its platform. As the crypto ecosystem evolves, projects continuously seek platforms that align with their goals and offer stability. Unfortunately for Solana, some significant projects decided to transition to other platforms, casting a shadow over its reputation.

By the end of the previous year, notable NFT collections and projects announced their migration from Solana to other platforms like Polygon and Ethereum. Such moves not only impact the immediate value and trust in Solana but also raise questions about its long-term viability. Phrases like “Does Solana have a future?” became more common, reflecting the market’s sentiment.

Solana’s Road Ahead: Recovery and Future Potential

The journey of any cryptocurrency is marked by peaks and valleys, and Solana is no exception. While recent events have led to speculations and concerns, it’s crucial to look beyond the immediate and envision the road ahead for Solana. Is the narrative of “Solana dead” an overreaction, or does Solana genuinely face existential threats?

Solana’s Strengths and Opportunities

One of Solana’s undeniable strengths is its potential to host decentralized applications (DApps) efficiently. As the demand for DApps grows, platforms like Solana that can offer scalability without compromising on speed become invaluable. Moreover, the rise of Solana-based NFTs and DeFi protocols indicates a vibrant ecosystem that can drive growth and innovation.

While challenges like system downtimes and project migrations have cast a shadow, they also present opportunities. By addressing these issues head-on and ensuring robust solutions, Solana can regain trust and solidify its position in the market.

Conclusion: Solana’s Long-Term Viability

As we wrap up our exploration into Solana’s journey, it’s evident that the platform, like any other in the crypto realm, has its share of challenges and triumphs. The whispers of “Is Solana dead?” or concerns about a “Sol crash” are but a reflection of the volatile nature of the cryptocurrency market.

However, to truly gauge Solana’s long-term viability, one must look beyond the immediate setbacks. Its innovative approach to blockchain technology, combined with a vision for a decentralized future, positions Solana as a contender in the crypto race. While the road might be fraught with obstacles, the potential for growth and innovation remains.