In a recent study orchestrated by the Organisation for Economic Co-operation and Development (OECD) this spring, the allure of cryptocurrency has surged among the French, positioning it as the second-favored investment choice. The findings, disclosed by the Autorité des Marchés Financiers, France’s chief financial watchdog, on November 13, show an intriguing trend in the nation’s investment landscape.

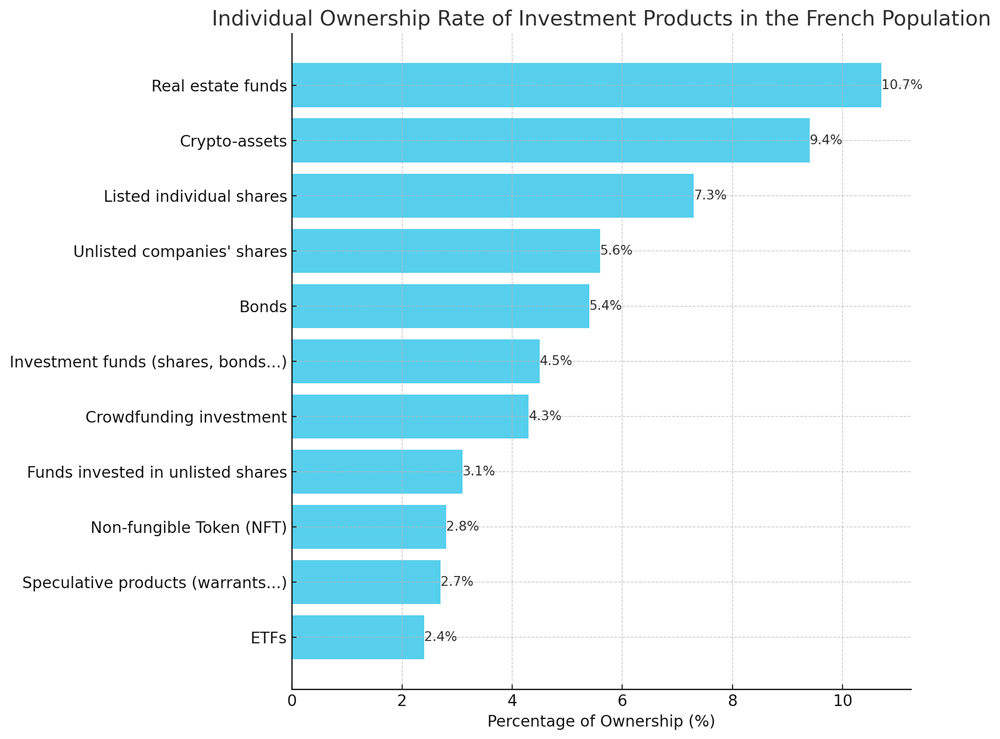

A notable 9.4% of adults in France now hold crypto assets, a figure just shy of the 10.7% who invest in the top-ranking real estate funds. The digital wave continues with 2.8% of those surveyed holding nonfungible tokens (NFTs), underscoring the growing appeal of blockchain-based assets.

The OECD’s survey casts a spotlight on the demographic of “new investors” – those who have ventured into investments post-March 2020, amid the COVID-19 pandemic. This group, predominantly male (64%) and averaging 36 years of age, contrasts with the more seasoned investors’ average age of 51. A striking 54% of these new investors have embraced crypto assets.

However, the survey also brings to the fore concerns about the financial literacy of these investors, particularly the youngest cohort, aged 18–24. Their grasp of investment fundamentals appears less firm, with a higher likelihood of incorrect responses on investment strategy basics compared to their older counterparts.

The research, involving 1,056 individuals and supplemented by 40 in-depth interviews, delves into the motivations and needs of these modern investors. It reflects a broader narrative of France’s commitment to becoming a frontrunner in the digital economy and innovation within Europe.