In the dynamic world of cryptocurrency, bitcoin miners are seizing the day, capitalizing on the digital currency’s recent surge. The industry, once languishing in stagnation, has been revitalized by bitcoin’s upward trajectory. As mining entities hasten to secure gains, they are acutely aware of the impending ‘halving’ – a pivotal event slated for April 2024 that will reduce their bitcoin rewards by half.

Gregory Lewis, an analyst at BTIG with a focus on the largest U.S.-listed bitcoin mining firms, observes a palpable sense of immediacy. “You’re seeing a lot of urgency to plug rigs in ahead of the halving,” he notes, emphasizing the rush to maximize earnings.

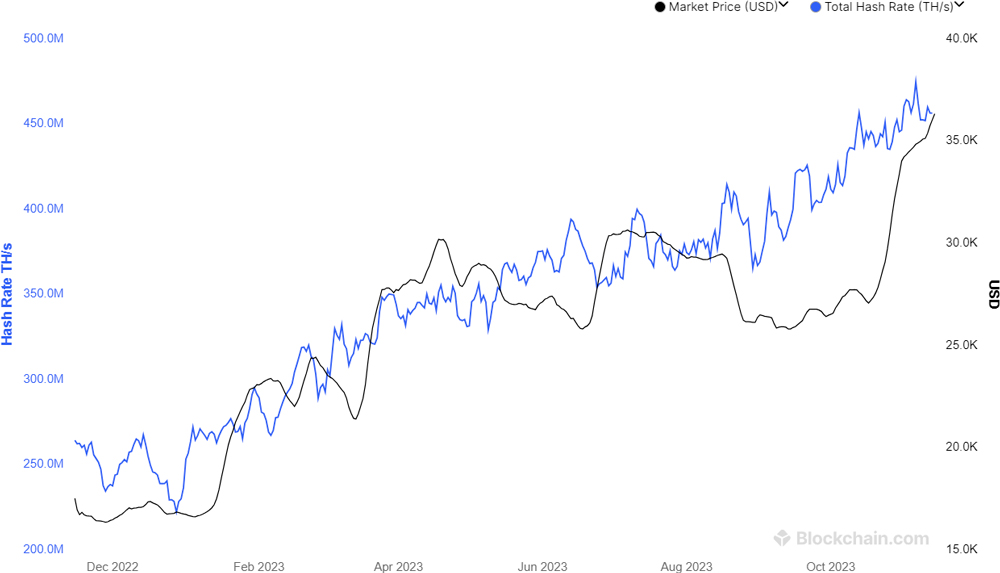

The fervor is mirrored in bitcoin’s hashrate, which Blockchain.com reports has reached unprecedented levels. This metric, indicative of the processing power required for mining, underscores the escalating difficulty and energy expenditure needed to solve the cryptographic puzzles that yield bitcoin.

J.P. Morgan analysts have tracked this intensification, noting an 11-month streak of record-breaking hashrates, punctuated by an extraordinary spike in October. This growth in computational demand is a testament to the increasing challenges miners face.

Currently, bitcoin stands at approximately $37,000, a significant 37% increase over the past month, inspiring miners to connect their high-powered machinery and unearth new coins. Blockchain.com’s data reveals a steady climb in the 30-day average revenue for miners, reaching an 18-month high of $32.46 million as of November 11.

Yet, despite this uptick, the profitability of mining has not returned to its zenith of 2021. The revenue per petahash per second – a measure of mining efficiency – has indeed improved from $70 to over $81 since the beginning of November. However, it lags behind the early May peak of $127.

With the halving on the horizon and only six months remaining, miners are strategizing to maintain their profit margins in a fiercely competitive landscape. William Szamosszegi, CEO of Sazmining, encapsulates the sentiment: “Every halving forces miners not playing that game at a high enough level to get washed out.” His words resonate with the high-stakes nature of bitcoin mining, where only the most efficient can thrive.